Series A

There should be clear evidence that the company is ready to go to the next level. This evidence can be based on established interest, early revenue or Key Performance Indicators that show there’s enough reason to continue in development.

The Series A round of investment tends to rely on start-up’s having a plan for developing a functioning business model, even if it’s not yet been proven yet. At this stage, any windfall is expected to be converted into a credible revenue stream.

Series A is a pivotal part of a start-up’s progression, and thus funds usually climb to between €2 million and €15 million. However, with higher windfalls comes the demand for more substance. Investors will be seeking out more tangible evidence than a founder simply having a good idea, and start-up owners will need to prove that a good idea can be converted into a profitable business.

This stage in a company’s funding is usually driven by a single investor that orchestrates the whole of Series A. Finding that first investor is perhaps the single most important part of the financing of a new business – this is because once one commits to your start-up, others tend to follow suit.

Likewise, losing your first investor can be a hammer blow, because there’s always a risk that others will pull the plug too.

Venture capital firms tend to bankroll Series A funding, but there could be some involvement from angel investors. Likewise, equity crowd funders have risen in popularity over the previous five years.

This stage in a company’s funding is usually driven by a single investor that orchestrates the whole of Series A. Finding that first investor is perhaps the single most important part of the financing of a new business – this is because once one commits to your start-up, others tend to follow suit.

Likewise, losing your first investor can be a hammer blow, because there’s always a risk that others will pull the plug too.

Venture capital firms tend to bankroll Series A funding, but there could be some involvement from angel investors. Likewise, equity crowd funders have risen in popularity over the previous five years.

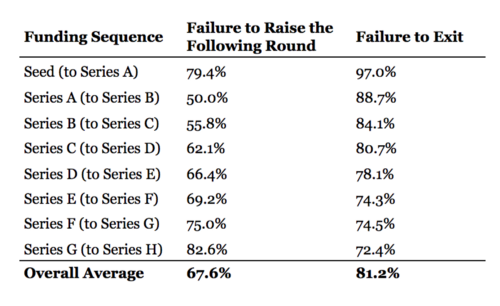

Interestingly, while start-ups will almost always find themselves in choppy waters throughout the funding process, arriving at Series A represents a significant step towards stability, with the typical progression rate from Series A to B start-ups sitting at a comparatively appealing 50%.

Interestingly, while start-ups will almost always find themselves in choppy waters throughout the funding process, arriving at Series A represents a significant step towards stability, with the typical progression rate from Series A to B start-ups sitting at a comparatively appealing 50%.While making the transition from seed funding to Series A represents one of the biggest leaps of faith for a start-up, once a willing investor is found and is ready to help you scale, the early Series could be seen as statistically less volatile than seed rounds.

However, with that said Series A and B funding only represents the eye of the storm, with average start-up failure rates leaping with every subsequent stage your business embarks on. By the time you arrive at the latter series of investment, your chances of progression fall to just 17.4%. The good news is that with the right level of investment and scaling, your business should be up and running and progressing fast enough to bypass those difficult latter stages of investment to enter the world as a fully-fledged scaled business.